Six-Step Guide for Transferring Property Titles

Transferring the property title to the new owner is the most important step after you buy a house. This is a tedious process requiring certain documents to be secured and several fees that must be settled. It could extend to a few months, but this is a necessary step in securing your home’s ownership.

One necessary step in this process includes validating the authenticity of the land’s title and securing the transfer of the title from the seller’s ownership to yours.

The title is proof of ownership of the property. If you don’t secure the transfer, you could run into legal problems in the future. Even before you buy a property, make sure to plan out the steps of executing the transfer of its title already.

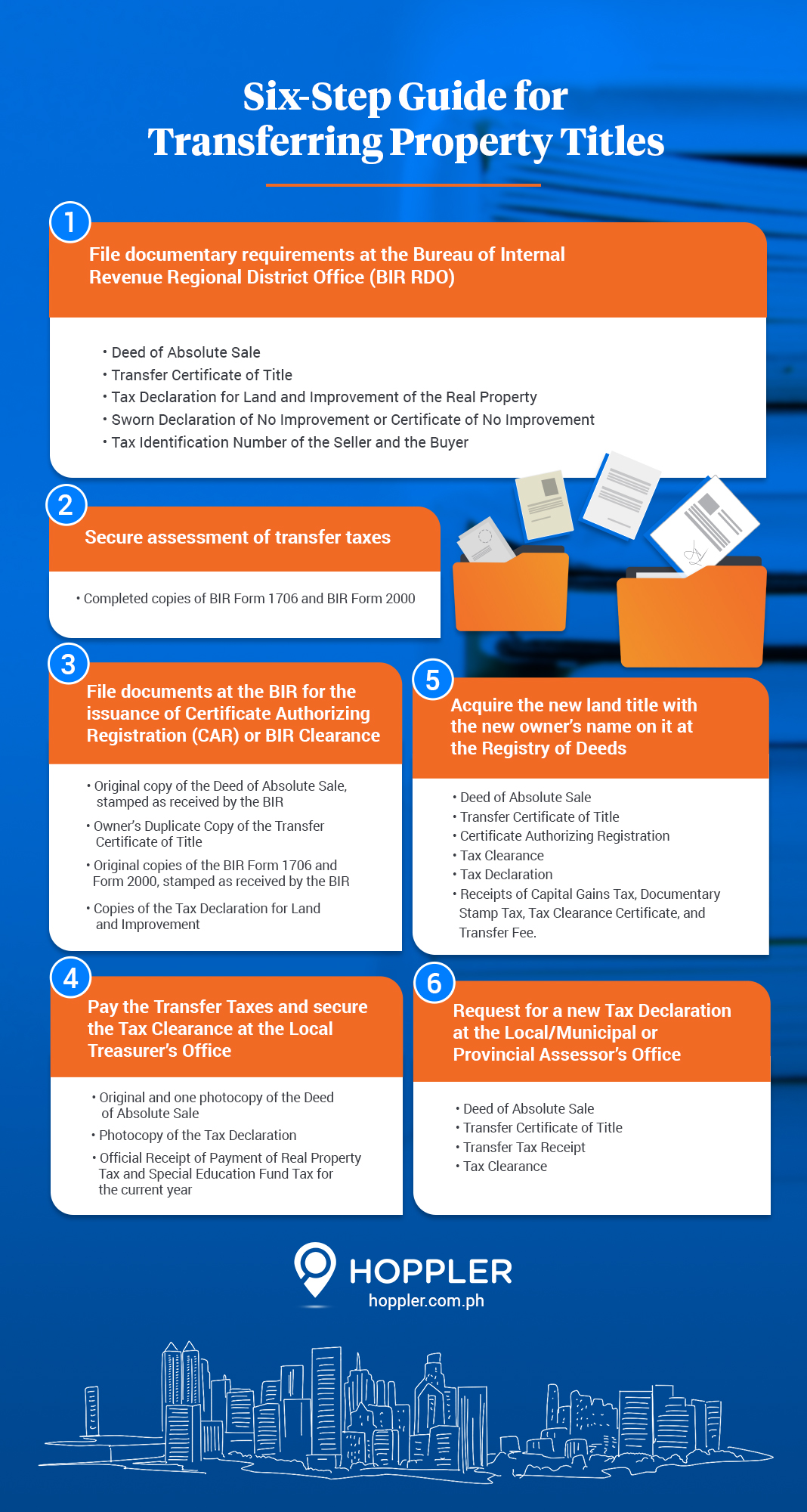

Here’s a six-step guide to help you process the transfer of your land title:

1. File documentary requirements at the Bureau of Internal Revenue Regional District Office (BIR RDO)

Requirements:

- (1) Original copy and (2) photocopies of the notarized Deed of Absolute Sale (DAS)

- (1) Owner’s duplicate copy and (2) photocopies of the Transfer Certificate of Title (TCT)

- (1) Certified True Copies and (2) photocopies of the latest Tax Declaration for land and improvement of the real property.

- A Sworn Declaration of No Improvement by at least one of the transferees or Certificate of No Improvement issued by the city or municipal assessor is required for Vacant lots

- Tax Identification Numbers (TIN) of the Seller and Buyer

In some instances, the BIR might require a Special Power of Attorney (SPA), if the person processing the transfer is not the signatory in the deed of sale; a Certification of the Philippine Consulate, if the SPA is executed abroad; a vicinity map or location plan if the zonal value cannot be determined.

2. Secure assessment of transfer taxes

After filing the required documents, a BIR representative will calculate your Capital Gains Tax and Documentary Stamp Tax. Whoever pays the Capital Gains Tax (CGT) and Documentary Stamp Tax (DST) is based on the agreed upon terms of the buyer and the seller.

The BIR will ask you to complete three (3) copies each of BIR Form 1706 (CGT) and BIR Form 2000 (DST). These will then be filed at the Authorized Agent Bank (AAB). For areas where there are no AABs, they will be filed with the Authorized City or Municipal Treasurer.

3. File documents at the BIR for the issuance of Certificate Authorizing Registration (CAR) or BIR Clearance

You will receive a claim slip with the claim date of the CAR, which will be released along with the following documents:

- Original copy of the Deed of Absolute Sale, stamped as received by the BIR

- Owner’s Duplicate Copy of the Transfer Certificate of Title

- Original copies of the BIR Form 1706 and Form 2000, stamped as received by the BIR

- Copies of the Tax Declaration for land and improvement

4. Pay the Transfer Taxes and secure the Tax Clearance at the Local Treasurer’s Office

Requirements:

- Original and one photocopy of the Deed of Absolute Sale

- Photocopy of the Tax Declaration

- Official Receipt of Payment of Real Property Tax and Special Education Fund Tax for the current year

5. Acquire the new land title with the new owner’s name on it at the Registry of Deeds

The Registry of Deeds will release the new Transfer Certificate of Title under your name after paying the registration fee.

Additional requirements:

- Deed of Absolute Sale

- Transfer Certificate of Title

- Certificate Authorizing Registration

- Tax Clearance

- Tax Declaration

- Receipts of Capital Gains Tax, Documentary Stamp Tax, Tax Clearance Certificate, and Transfer Fee.

6. Request for a new Tax Declaration at the Local/Municipal or Provincial Assessor’s Office

Requirements:

- Deed of Absolute Sale

- Transfer Certificate of Title

- Transfer Tax Receipt

- Tax Clearance