The Builders: 12 Top Real Estate Developers in the Philippines (Part 1 of 3)

The year 2013 has been a prolific year for the Philippine real estate industry. Stable economic growth, low interest rates, and increasing home investment of overseas Filipino workers drove the steady demand in the local property market. Add in the continuous growth of foreign investment, expansion of the off-shoring and outsourcing industries, and the influx of expatriate workers. All these factors have combined to shape the property boom that is changing the skyline not only of the metropolitan region but of the provincial cities as well.

Things got sweeter when the Philippines’ credit rating was upgraded from BB+ to BBB- by Standard & Poor’s and Fitch, showing that the economy is doing well. This was topped when the country was included in Condé Nast Traveller Magazine’s list of destinations to watch in 2013. More recognition followed from major international publications. The Philippines was included in Travel+Leisure Magazine’s list of 13 “Hottest Travel Destinations of 2013” and placed 17th on New York Times Magazine’s list of “The 46 Places to Go in 2013”. While the citations focused on the country’s familiar beach spots, they added to the palpable buzz of optimism and confidence felt across sectors of the Philippines’ property market.

Here’s a look at twelve of the country’s top property developers.

Ayala Land, Inc.

Having launched 67 projects worth a total of P90-billion in 2012 and netted P6.6 billion in profit last 2013; Ayala Land, Inc. (ALI) is considered the largest property developer in the country. With a portfolio spanning the full range of residential and commercial development nationwide, ALI is also considered to be the most diversified developer.

ALI kick-started last 2013 with the mid-January launch of the 21-hectare Circuit Makati project with the Philippine Racing Club Inc. (PRIC). A five-year development plan is targeted for the P20-billion mixed-use development that would transform the former Sta. Ana racetrack into Makati’s newest entertainment hub. Featuring three distinct venues – Circuit Theater, Circuit Lane, and Circuit Event Grounds – the project aims to be an interactive entertainment venue for families.

Also lined up is the development of the sprawling 74-hectare Food Terminal Inc. in Taguig, master-planned to be southern metro’s modern business district. Expanding their reach in northern Metro Manila, ALI also plans to redevelop the Gatchalian-owned 17-hectare “Plastic City” estate in Valenzuela into a mixed-use urban complex.

While the property giant started out as a high-end developer, it has now tapped into the mass housing market with the 2011 launch of its fifth residential brand, South Maya Ventures Corp. Its first project, Bella Vita in Cavite, was launched in the last quarter of 2012.

ALI’s four other residential brands serve specific market segments. The upscale brand, Ayala Land Premier, launched in November 2013 its latest offering – Garden Towers in Ayala Center. Middle-upper market brand Alveo Land has ongoing projects in Bonifacio Global City (The Meridien), Cebu (Solinea), and Tagaytay (KasaLuntian) while new projects in the metro and emerging provincial cities such as Laguna, Cavite, Lipa, Cebu, Bacolod were launched by middle and low-middle market brands, Avida and Amaia Land.

With the opening of Centrio complex in Cagayan de Oro and the first phase of Ayala Center’s redevelopment worth P 28.5-billion taking shape, ALI’s shopping and retail division does not lag behind. Earlier, ALI and Rustan’s Group signed up with FamilyMart Group and parent company Itochu Corp. to develop and operate FamilyMart convenience stores in the country. While heating up the local competition for 24-hour retail chains, the move will also enable ALI to provide retail stores to support its mixed-use communities.

Compared to other property divisions, ALI’s office development arm, Ayala Land Businesscapes, keeps a low profile while posting a 19 percent revenue increase in 2012 from its office leasing operations. With more or less 12 completed projects in its portfolio, it is slowly but surely developing office buildings that cater to the specific demands of IT and BPO companies. Some of these projects are VertexOne in Manila, UP-Ayala Land TechnoHub in Commonwealth Ave., Solaris One in Makati, and One EvotechNuvali in Laguna.

On the leisure front, Ayala Hotels and Resort Corp. boosted their hotel portfolio with the opening of Raffles Residences and Fairmont Hotel in Ayala Center in 2012. Meanwhile, its three-group division enables them to (1) operate foreign brand hotels (Hotel Intercontinental Makati, Holiday Inn & Suites in Glorietta, Cebu City Marriott Hotel); (2) launch their own boutique hotel line (Kukun Hotels now rebranded as Seda Hotels in Bonifacio Global City, Nuvali, Davao, Cagayan de Oro); and (3) develop sustainable resort communities in El Nido, Palawan. The last one is an eco-tourism project which demonstrates ALI’s commitment to developing sustainable communities. By developing pilot farms, ALI helps local farmers grow their own produce and supply to the resort communities.

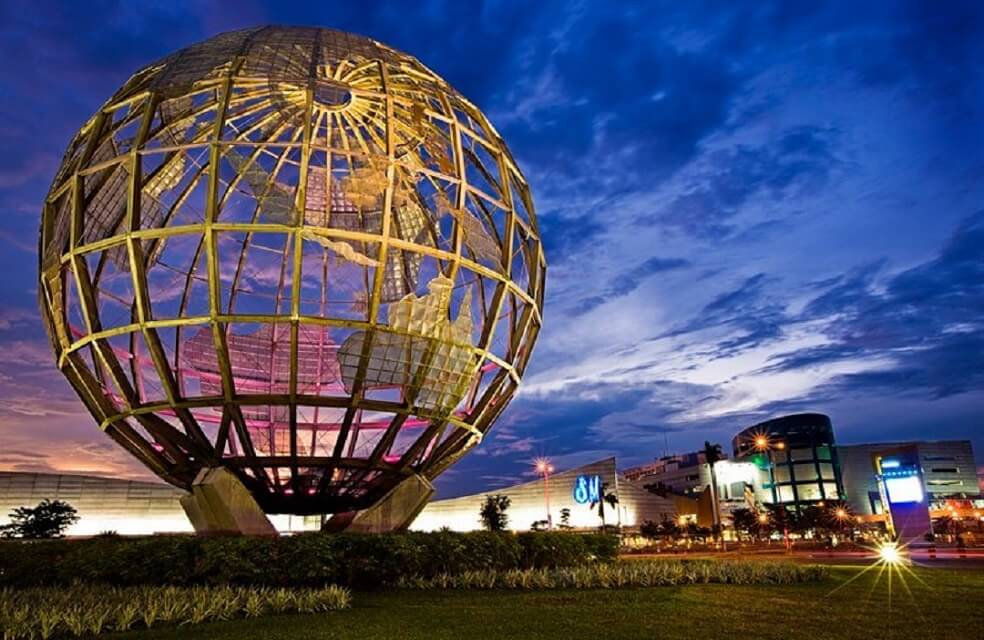

SM Land, Inc.

Posting a net profit that hit P 3.3-billion in the third quarter of 2012, the publicly listed residential arm of SM Land, SM Development Corporation (SMDC), is indeed a fast-rising residential property developer in the country, with international recognition to boot. In 2012, SMDC was one of the only three Philippine corporations included in Forbes Asia’s 200 “Best Under A Billion” list which honored 200 exceptional small and mid-sized companies with annual revenues between $5 million and $ 1 billion, have a positive net income, and are publicly traded.

SMDC’s two brands, SM Residences and M Place, target the premium middle market with high-rise condo living, with the latter catering specifically to the youth market. The 2011 launch of celebrity Anne Curtis as official endorser of SMDC’s condo projects provided effective exposure for some of its 18 residential projects. Strong sales were reported for ongoing projects: Shell Residences and Sea Residences, both located in the Mall of Asia Complex, are 87 percent and 95 percent sold, respectively. Meanwhile, as of November 2012, the 6,000-unit project in Quezon City, Grass Residences, is reported to be 97 percent sold. Launched in 2007, its remaining tower is slated for completion this year.

Also under the residential segment of SM Land, Highlands Prime is a leisure real estate developer within Tagaytay Highlands, an exclusive mountain resort and residential complex. It currently has nine projects, three of which are condominium developments and six are residential lot developments. The condo projects range from mid-rise, medium density condos to a horizontal development of single detached log cabins. Three quarters into 2012, Highlands Prime posted a P29.2-million income, with revenues doubling up to P419.9-million, 51 percent of which came from residential lots and the remaining 49 percent from condos and log cabins.

SM Land is also slowly building up its hotel and resort portfolio. Now operating in full swing is Costa del Hamilo’s Pico de Loro Cove, a resort community in the coasts of Nasugbu, Batangas. Developed as a leisure project of SM Land, Pico De Loro Cove features low-impact residential condos, a hotel, beach and country club, restaurants, sports facilities, and ferry service. Hotel properties of the SM Group include the Taal Vista Hotel in Tagaytay which target leisure and business travelers, the Radisson Blu Hotel in Cebu, the Radisson Hotel Manila Bay, and the Regent Manila Bay, the last two situated in Mall of Asia Complex. The holding company, SM Investments Corp. (SMIC), signed up with international hotel services provider Carlson Hotels Worldwide Asia Pacific to manage the Radisson and Regent branded hotels.

Known as the country’s biggest developer of shopping malls, SM Prime Holdings opened last September 2013 its 46th shopping mall in the country, SM Lanang Premier in Davao. With 144,000 square meters in gross floor area, it is the biggest and first premier mall in Mindanao. Aside from operating the largest retail chain in the country, SM Group also operates rapidly growing standalone retail chains such as SaveMore Supermarket and SM Hypermarket. With the 2004 withdrawal of the Ayala group in the joint venture, the SM Group now owns 100% of Pilipinas Makro stores which have been converted to Savemore and SM Hypermarkets.

To further strengthen its massive commercial front, the Commercial Properties Group of SM Land has been developing office buildings in key cities and in its Mall of Asia Complex where it has completed two of the four E-com buildings, each with a capacity of close to 70,000 square meters. TwoE-com, one of the completed premier office buildings, was recognized in April 2013 as the Best Office Development in the Philippines in the 2012 Asia Pacific Property Awards. Addressing the demand for an expansive entertainment and sporting events venue, the commercial group’s latest venture is the Mall of Asia Arena, a 62,000-sqm sports-and-multi-event complex which just opened in June last year.

Megaworld Corporation

The year 2011 put tycoon Andrew Tan’s Megaworld Corp. on the world property market map with its recognition by two leading global property consultants as the country’s top residential condominium developer. The Colliers International research cited Megaworld as the largest builder of residential condos in terms of units completed in 2010 and those that will be completed between 2011 and 2016. Leading property consultant CB Richard Ellis gave Megaworld the same recognition for launching more than 40,000 condo units between 2001 and 2011.

However, even before this achievement, Megaworld has pioneered the mixed-use development of real estate in the form of community townships that fuse the live-work-play concept with the demands of BPO firms. Its Eastwood City township project with residential condo towers, cyberpark, and mall has transformed Libis, Quezon City into one of the emerging business districts in the metro.

Other landmark projects such as McKinley Hill and Forbes Town Center cater to an international clientele and contribute to the emergence of Bonifacio Global City in Taguig as a progressive business district next to Makati CBD. Another project, Newport City in Pasay, combines residential development with hotels and a themed entertainment and commercial hub.

In 2011, Megaworld unveiled a total of eight new projects – mostly luxury condos in the business districts of the metro (specifically in Eastwood City, Newport City, Bonifacio Global City, Araneta Center, and Makati and one in Mactan, Cebu). In 2012, Megaworld earmarked P25-billion to develop ongoing projects while investing P65-billion to further develop Uptown Bonifacio for the next 20 years. It topped off its 2012 achievements with its turnover of Greenbelt Madison in Legaspi Village, a luxury condo with fully-furnished units that are ready for occupancy. In 2013, Megaworld allocated P25-billion to develop its latest integrated township project in the West Visayas, the 54-hectare Iloilo Business Park slated for completion by 2015.

While the Megaworld brand caters to the upscale segment, its two subsidiaries, Empire East Land Holdings and Suntrust Properties, seek a wider range of housing customers. Empire East Land Holdings, Inc. targets the middle-income housing segment with township residential projects located in and out of the metro. In July 2012, it partnered with the Kazuo Okada Group for a joint venture to develop a P45-billion luxury condo project in Pagcor Entertainment City.

Meanwhile, Suntrust Properties, Inc. has won several awards in economic housing development. It offers affordable homes which serve low- to moderate-income families. Although its township projects are located in Cavite and Laguna, Suntrust Properties also have ongoing condo projects in the metro. Its latest projects are Suntrust Shanata in Quirino Avenue and Suntrust Capitol Plaza in Diliman, Quezon City, both undergoing construction.

Robinsons Land Corporation

Recently, Euromoney Magazine cited Robinsons Land Corp. (RLC) as the best managed company in Asia based on a 2012 real estate poll of 130 leading equity analysts from major investment houses in the Asia Pacific region. In terms of transparency in investor relations, management accessibility, and strategy, RLC topped the list of 207 companies nominated in the benchmark survey. With its property portfolio, its top performance in last year’s Philippine Stock Exchange index, and P10.56-billion revenue in the first half of 2012, the citation is well earned.

In 2012, RLC allotted P15-billion for capital spending which focused on projects that seek to expand its recurring income base. These projects include shopping mall, hotel, and office development, which account for 81 percent of company profits. In addition to the two newly opened malls last year –Robinsons Place in Calasiao, Pangasinan and Robinsons Magnolia along Aurora Boulevard – Robinsons Town Mall is set to open in Malabon by December this year.

Aside from continuously expanding its mall base, RLC made a smart move to promote public service while boosting foot traffic within its malls. Nowadays, anyone applying for government papers like NBI clearance or passport has the option of going to a Robinsons Mall. Government agencies like NBI, SSS, GSIS, PhilHealth, Pag-Ibig, DFA, LTO, LRA, and DOT now have satellite offices in Robinsons malls. These enclaves comprise what is called the Robinsons Mall LingkodPinoy Center (RMLPC).

A rising trend in hotel occupancy rates coupled with the pilot success of its Go Hotel at Cybergate Plaza in Mandaluyong City spurred RLC to open another branch in Puerto Princesa in February 2012. Three more branches opened in Tacloban, Dumaguete, and Bacolod during the same year, while another three Go Hotels were completed in 2013. Set to roll out 30 more branches in the next five years, RLC envisions an extensive chain of budget hotels. This aside from its International Hotel Group (IHG)-managed hotels such as Crowne Plaza Galleria, Holiday Inn Galleria Manila, and its RLC-managed Summit Circle Hotel in Cebu and Summit Circle Hotel in Tagaytay.

In the office development front, RLC office buildings dominate the Ortigas Business District. Aside from the Robinsons Equitable Tower and the Galleria Corporate Center, RLC is set to expand its available office space with the near completion of Cyberspace Alpha and Cyberspace Beta. The two-office complex will have a combined gross floor area of about 80,000 sqm and column-free spaces ideal for BPO companies.

Under its residential division, RLC has four brands – Robinsons Luxuria, Robinsons Residences, Robinsons Communities, and Robinsons Homes – each with their distinct target market and type of development. One of its newest projects under the Robinsons Communities brand is the Axis Residences, a two-tower 42-storey development set to rise within the Robinsons Cybergate Complex in Mandaluyong. The project is a joint venture by RLC and another property giant, Federal Land Inc.

Follow the rest of this three-part series: Part 2 and Part 3.