TRAIN and Its Impact on Real Estate

The Tax Reform for Acceleration and Inclusion (TRAIN) or Republic Act (RA) No. 10963 is now in effect. Aside from the reduced personal income tax rates and revised excise taxes, estate and donor’s taxes were also revised.

Here are the changes you need to know about estate and donor’s taxes under TRAIN:

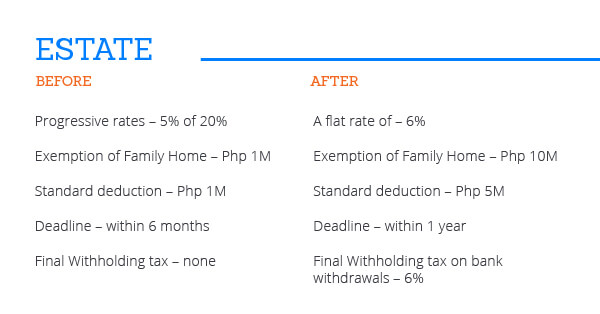

Estate Tax

The rate of the Estate Tax – a tax imposed on the property of lawful heirs and beneficiaries inherited from a decedent – is now at a flat rate of 6% on the amount in excess of P5 million from the previous 5% to 32% rate.

Additionally, estates with a net value of P5 million and below, and family homes that are valued at P10 million or less are now exempted from tax. The former tax laws permit that only family homes worth P1 million were exempted.

The deadline for filing of estate tax return is now within one year from death.

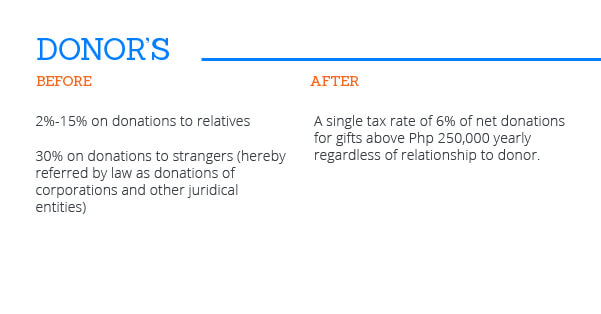

Donor’s Tax

The rate of the Donor’s Tax – a tax on donation or gift, and is imposed on the gratuitous transfer of property between two or more persons who are living at the time of the transfer – is now at a flat rate of 6% regardless of the relationship between the donor and the donee from the previous 2% to 15% if the donor and the donee are related, and 30% if the donation was to a stranger.

Donations or gifts below P250,000 are exempted from tax while those that are worth at least P250,000 are subject to a flat rate of 6%. Additionally, donation of real property is now subject to Documentary Stamp Tax of P15 for every P1,000.

Value Added Tax

Association dues, membership fees, and other charges collected by homeowners’ associations and condominium corporations are now exempted from VAT.

Sale of a residential lot and house and lot not more than P1.5 million and not more than P2.5M respectively are also exempted from VAT.

The TRAIN law aims to simplify tax compliance and for the real estate sector, the amendment will encourage heirs to declare the real value of their deceased relative’s estate and to pay the appropriate taxes, and inspire more Filipinos to invest in real estate be it in key cities like Makati, Taguig, Muntinlupa, or in the province.

Sources: bir.gov.ph