How to be a Smart Contrarian Investor

Michael Lewis wrote the following on contrarianism in his classic book on financial markets, “Liar’s Poker”:

Everyone wants to be, but no one is, for the sad reason that most investors are scared of looking foolish. Investors do not fear losing money as much as they fear solitude, by which I mean taking risks that others avoid. When they are caught losing money alone, they have no excuse for their mistake, and most investors, like most people, need excuses. They are, strangely enough, happy to stand on the edge of a precipice as long as they are joined by a few thousand others…

Contrarianism is the most abused and empty platitude in trading and investing. Everybody thinks they’re one, but few are. And that, by its very nature, has to be the case. Because to be a contrarian is to go against the herd, against the majority.

Hedge-fund legend Ray Dalio put it like this, “You can’t make money agreeing with the consensus view, which is already embedded in the price.”

So, how can we act as an effective contrarian and not someone who just ignorantly jumps in front of market freight-trains?

George Soros, who is one of, if not the, greatest contrarians of all time has famously stated that most of the time he is a trend follower:

“I am often considered a contrarian. But I am very cautious about going against the herd … Most of the time I am a trend follower, but all the time I am aware that I am a member of the herd and I am on the lookout for inflection points … I watch out for telltale signs that a trend may be exhausted. Then I disengage from the herd and look for a different investment thesis. Or, if I think the trend has been carried to excess, I may probe going against it”

There are two key takeaways from this… the first is to be very cautious about trading against the herd. Humbleness is a superpower in markets. The second is that you need to recognize when you are a part of the herd so you can be on the lookout for signs that the trend has been carried to an excess (the trend became consensus).

Druckenmiller’s first mentor, Speros Dreller, would often tell him that “60 million Frenchman can’t be wrong”. He was teaching the young Druck about the wisdom of the market, which is based on the idea that the crowd is collectively smarter than any one individual.

This group intelligence was first happened upon by the late great statistician, Francis Galton, who in 1906 observed a competition at a local fair where approximately 800 people tried to guess the weight of an ox. To his surprise, the average of all the guesses was 1,197lbs. The real weight was 1,198lbs.

A crowd is often smarter than even the best of its individuals and will always predict more accurately than the average individual, but for these to hold true there needs to exist a diversity of opinion within the crowd. This is known as the “diversity prediction theorem”..

“Just because 51% of the crowd is bullish and 49% is bearish is no reason the market cannot go higher. In fact, it probably will advance at that point. The time to be wary of crowd psychology is when the crowd gets extraordinarily one-sided” ~ Marty Zweig

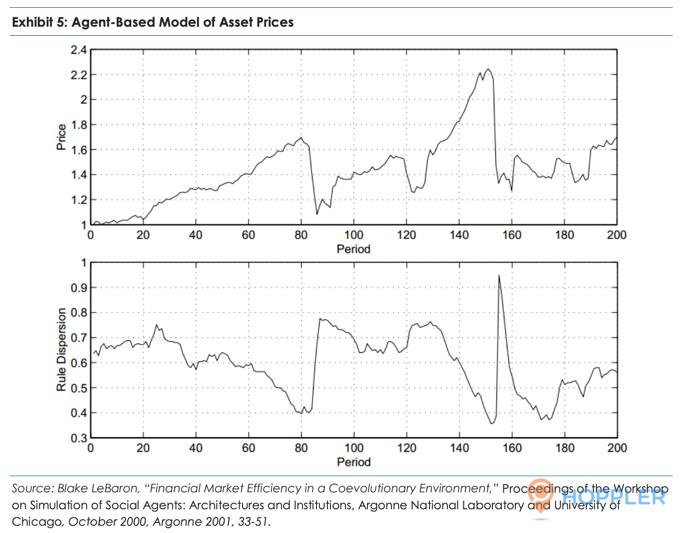

Blake LeBaron, an economist, modeled how this diverse and wise and consensus but dumb crowd works in markets to create trends and crashes. He built a computer model and imbued “agents” with decision-making rules such as: make money, try not to lose money, don’t underperform the average for long periods, etc.

What he found was that “During the run-up to a crash, population diversity falls. Agents begin to use very similar trading strategies as their common good performance begins to reinforce… This makes the population brittle…Traders have a hard time finding … anyone to sell to in a falling market since everyone else is following very similar strategies.”

This explains the mechanics of why financial markets trend and revert.

So to conclude, you want to be a trend follower when there’s a lot of people saying “this move makes NO SENSE” and a contrarian when people are saying “this makes SO much sense”… This is why a bull climbs a wall of worry and a bear falls down the stairs of hope. But… and this is important, you ONLY want to be a contrarian once the tape STOPS confirming the consensus narrative. Reading the consensus tea leaves is as much an art as it is a science. And when in doubt, defer to the market.